- Products

- All Products

- RF PA Extension Kit

- Wireless Microphone Upgrade Packs

- In-Ear Monitor Upgrade Packs

- Wireless Microphone Antennas

- Wireless In-Ear Monitor Antennas

- Antenna Distribution for Microphones

- Antenna Combiners for In-Ear Monitors

- Multi-Zone Antenna Combiners

- Spectrum Tools

- Accessories, Cables and Parts

- Solutions by Venue

- Resources & Training

- Performance Tools

- About Us

December 15, 2014

This Stuff Is Starting to Get Expensive: 65 MHz AWS-3 Spectrum Auction up near $19 Billion

Written by: Alex Milne

[Update: Jessica Rosenworcel says bids now at $43 billion. Insane]

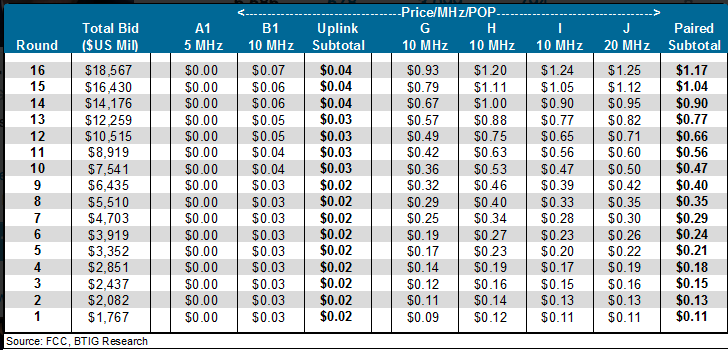

We don't usually talk directly about the cellular industry here, but FCC Auction 97, which is selling paired 25 MHz bands and another 15 MHz for AWS-3, is causing quite the stir. This is what got my attention: Walter Piecyk, an analyst at BTIG Research, tweeted, "I have monitored every @FCC spectrum auction and I don’t recall any rising to these levels, this fast." He accompanied the tweet with the above bid intelligence screen grab, showing the auction has risen well past $18 billion.

The spectrum attracting the most interest is the "G" "H" "I" and "J" bands. These are the paired spaces at 1755-1780 MHz and 2155-2180 MHz. There are another two bands totaling 15 MHz at 1695-1710 MHz, which don't seem to be very desirable right now.

The industry jargon here of "$ per MHz/POP" is the license bandwidth times the population in each individual license's coverage area, divided by the price. MHz/POP is the way wireless industry pros quantify the value and capacity of individual units of spectrum.

TMF Associate analyst Tim Farrar conjectured yesterday that fierce competition between three gigantic bidders (T-Mobile, Verizon, ATT), and one rogue agent (Dish), are frothing up into some sort of high-stakes corporate game theory escalation.

" By now it would have been expected that the three operators would sort themselves out and bid on a self-selected subset of licenses... However, it appears that this has all been disrupted by DISH’s desire to drive up the price. DISH has presumably concluded, logically, that the major operators will have to buy the New York and LA licenses (plus a few other places such as Chicago, Washington, Boston, San Francisco and Dallas) whatever the cost, so has been bidding simultaneously across all of the main licenses in these cities. "

I imagine a bunch of stone-faced lawyers in the back of the limousine from Don Delillo's Cosmopolis. Or, to use tried and true imagery, this:

With the exception of Dish, these same bidders are licking their lips at the thought of low-band 600 MHz spectrum (that's us). Ars Technica reported earlier this year that T-Mobile is especially ravenous:

"T-Mobile says its high-band spectrum is good for providing lots of capacity, but low-band spectrum is what carriers really want... While T-Mobile has good outdoor coverage in numerous big cities, it still has problems covering the insides of buildings and rural America. Unless T-Mobile gets a lot of low-band spectrum, it’s going to have a hard time matching the networks of its biggest rivals."

Both the FCC and the wireless industry are waiting on pins and needles to hear the words: "let the bidding begin."

Alex Milne

Alex Milne was Product Marketing Manager and Digital Marketing Manager for RF Venue, and a writer for the RF Venue Blog, from 2014-2017. He is founder and CEO of Terraband, Inc., a networking and ICT infrastructure company based in Brooklyn, NY., and blogs on spectrum management, and other topics where technology,...

More from the blog

Knowledge Guides

Incentive Auctions Fail to Meet Final Stage Rule, Reset to be Scheduled at Lower 114 MHz Target

4 min read

| August 31, 2016

Read More

Knowledge Guides

Incentive Auctions Begin, Spectrum for Wireless Audio Axed up to 60%

6 min read

| May 2, 2016

Read More

Knowledge Guides

Big Changes for Wireless Audio Industry in Store, Reveals New FCC Document

7 min read

| December 15, 2014

Read More

Subscribe to email updates

Stay up-to-date on what's happening at this blog and get additional content about the benefits of subscribing.